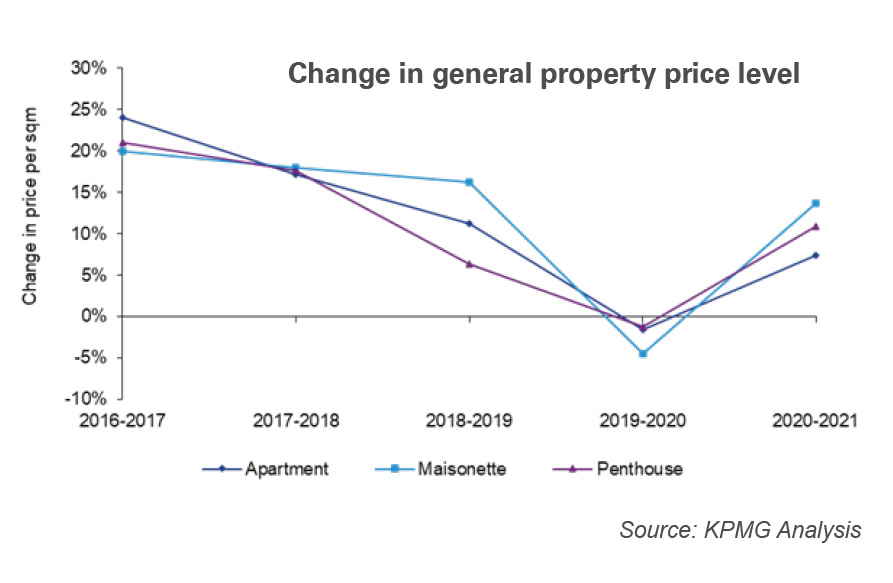

2021 saw a return to positive growth in terms of advertised price movements for apartments, maisonettes and penthouses, after a difficult 2020, when certain property markets experienced negative growth. This is healthy for the industry but seen within the context of the the emerging need to have a more sustainable building industry (and in turn, the link to building costs – which can lead to cost savings, if done cleverly), it is evident that such issues warrant further analysis and discussion.

For the purposes of this analysis, KPMG researchers considered the dataset collected between June and September 2021 with a total of 14,346 data points (each representing a residential property available for sale) were available for analysis.

Changes in property prices from year-to-year are driven by fluctuations in several variables. These can include but are not limited to, the location, condition, and views of the properties in the sample being analysed as compared to those in previous years. Changes in these variables will have an impact on movements in the average and median asking prices presented in this research.

The change in property price levels (while controlling for as many of these variables as possible) was calculated by considering the changes in the asking price per square meter of apartments, maisonettes, and penthouses, in a finished condition, having either unspecified or no views, and not forming part of any major real estate development project. The change in property prices for each type of property was then weighted in line with the number of listings from each region. The weighted average change in the asking price per square metre showed more variability across

property types than last year, with average asking prices increasing by around 7% for apartments, 14% for maisonettes and 11% for penthouses.

This observation is consistent with the general economic recovery experienced in 2021, bouncing back from negative growth in 2020. In fact, the change in property prices in 2020 from this controlled sample were -2%, -4% and -1% for apartments, maisonettes, and penthouses, respectively.

After a noted decline in the general advertised property price levels of these property types in 2020, asking prices have returned to pre-pandemic trends of year-on-year positive growth. This price increase may perhaps be indicative of the general recovery from the COVID-19 pandemic, which has since gradually retreated from its peak in 2020.

Context also plays an important role in understanding this trend. As part of the Maltese Government’s Economic Recovery Plan for Malta, announced in early June 2020, a reduction in taxes on the first €400k on contracts published by the 31st of March 2021 was implemented. Withholding tax on the sale of property was reduced from 8% to 5% (translating into a maximum saving of €12,000), and stamp duty was reduced from 5% to 1.5% (translating into a maximum saving of €14,000). These measures were then extended to apply to promises of sale signed by 31st December 2021 with the final deed by no later than 30 June 2022. Furthermore, the First-Time-Buyers Scheme, whereby FTBs are exempt from tax on the first €200,000 is still applicable, along with proposed measures to grant €10,000 to those who purchased their first property on or after January 2022.

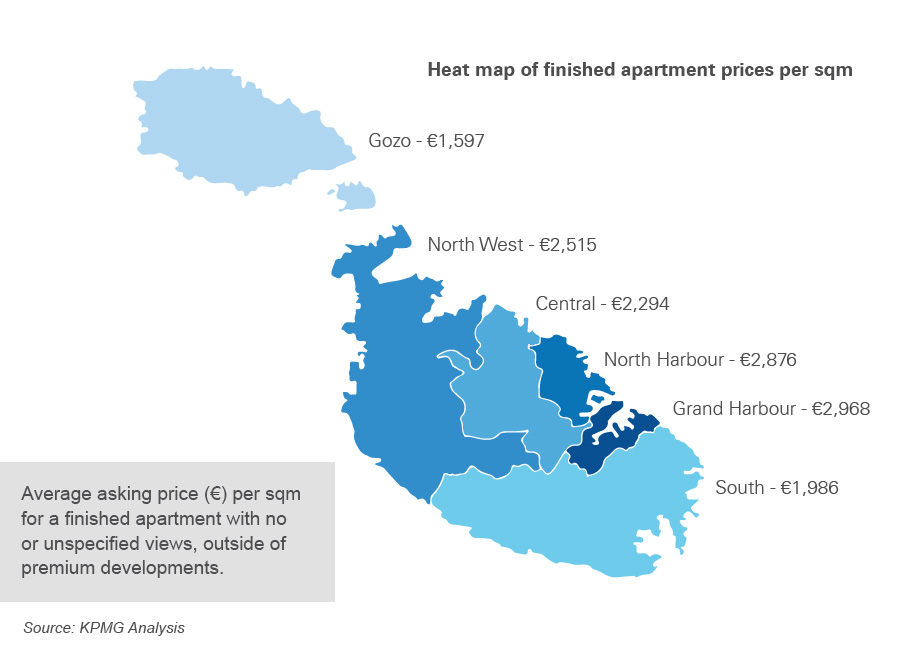

The above heatmap has been produced to provide a high level overview of the regional differences in prices of apartments. Only finished apartments, with no or unspecified views, an not including properties in premium developments (such as Tigne’ or Portomaso) were considered.