A detailed study of Airbnb property listings in Malta, published by the Central Bank (here), found that there are some 8,761 properties listed by 3,856 people, who could be making on average, as much as €2400 per month from each property.

Over the past years, Malta has seen a surge in the supply of units for short-term lets, an increase in tourists choosing private accommodation, and a downward trend in the share of collective accommodation. Recent years have also seen efforts by the authorities to require private operators to abide by regulations. Many countries are experiencing particular pressures driven by short term rentals of properties listed on Airbnb, as the sharing economy takes root.

The study estimates that Maltese Airbnb listings could collectively offer as much as 8 million bed nights.

Considering a likely occupancy rate of 70% with an average price of €80.20 per night, would generate revenues of €111.1 million. While, on average hosts would be able to earn as much as €2,400 a month, the top 10% of hosts would earn nearly two-thirds of the revenues.

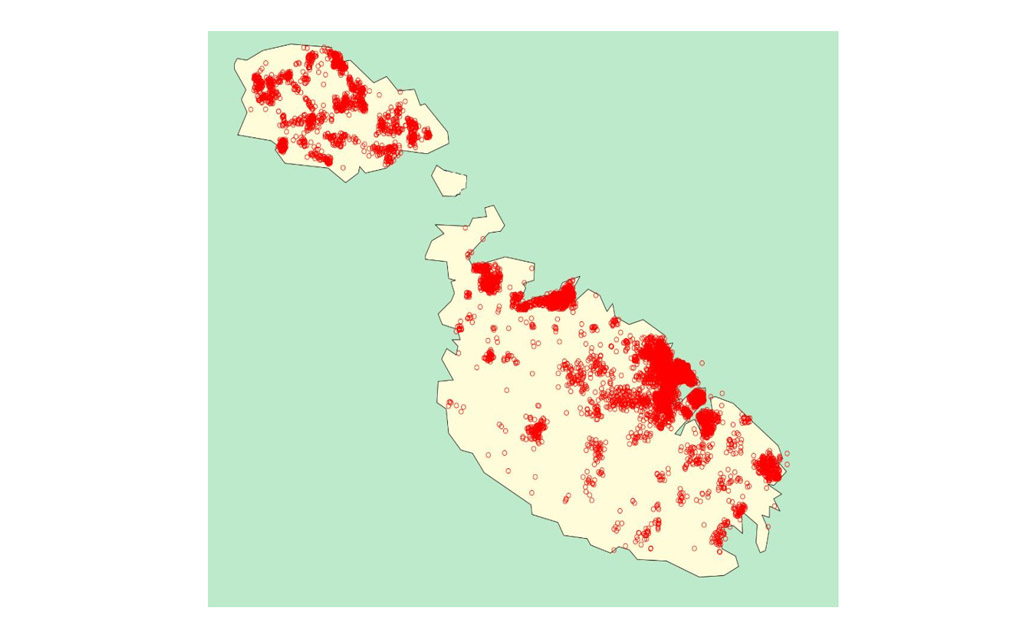

Most of the hosts offer whole dwellings for short-term lets, with the bulk being concentrated around the traditional tourist areas.

The top ten localities with listings in May 2019 are Sliema (12.0%), San Pawl il-Bahar (11.3%), San Giljan (8.9%), Mellieha (5.1%), Valletta (5.0%), Gzira (4.9%), Msida (4.1%), Swieqi (3.9%), Iz-Zebbug (Gozo)22 (3.7%) and Marsascala (3.1%). The spread of listings among localities, however, is wide (see Chart 4 and Table 1).23 The distribution confirms the predominance of established resort towns, and may indicate the conversion of holiday homes owned by Maltese into rental properties, as well as the economic usage intensity of the Northern Harbour region.

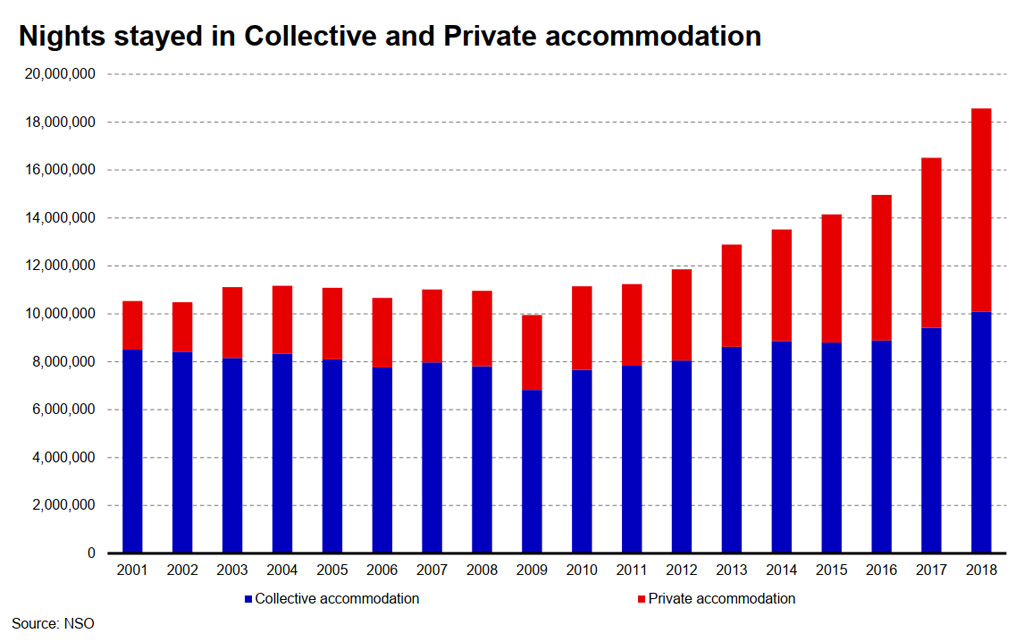

The report also notes that nights stayed in collective accommodation experienced strong growth in the ten years to 2018, rising from 7.8 million nights in 2008 to 10.1 million in 2018.

Growth in private accommodation was also strong, with nights stayed rising from 3.1 million in 2008 to 8.5 million in 2018. This figure, however, also includes a proportion of tourists who do not stay in rented accommodation while in Malta. This may comprise own accommodation, stays with friends or family, as well as other non-rented private accommodation.

It is apparent that while nights stayed in collective accommodation establishments increased in the three years to 2018, nights stayed in private accommodation rose by more. The share of nights stayed in private accommodation rose from 28.7% in 2008 to 45.7% in 2018.4 In the first quarter of 2019, the share of rented private accommodation in total rented accommodation stood at 31.1%.