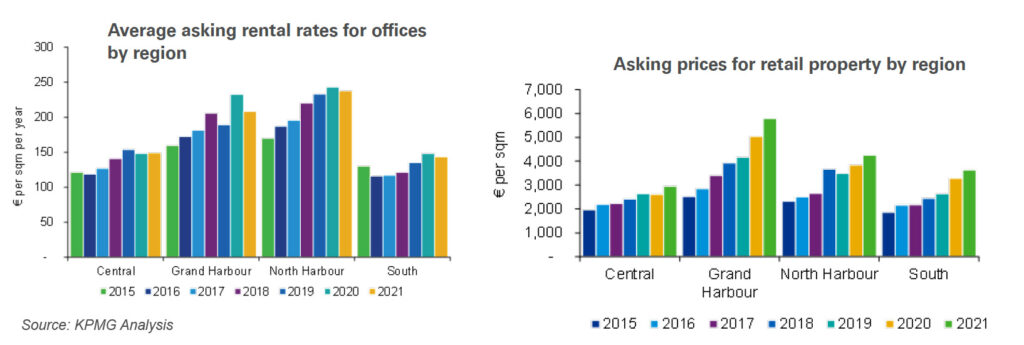

The majority of commercial property on the market is available on a rental basis rather than being offered for sale. Between 2020 and 2021, the average of the asking rental rates for office space decreased by 4% (down to €196/sqm in 2021 from €204/sqm), while average asking rental rates for retail properties increased by around 9% (up to €261/sqm in 2021 from €241/sqm).

Taking a closer look at the average asking rates for office space, the most substantial decrease in asking rental rates can be noted in the Grand Harbour region, with average rates falling by 10% (down to €209/sqm, from €233 in 2020). A significant element of this change may be attributed to variations in the underlying data, with 2021’s data set including a greater proportion of offices in Marsa, and fewer in Valletta, although it should be noted that the number of listings from this region fell drastically in this sample (from 319 to just 61). Average asking rental rates also decreased for offices in the Southern and North Harbour regions, which saw declines of 6% and 3% respectively. The Central region recorded no growth over 2020, while the North West region, and Gozo have been excluded from this analysis due to insufficient data points.

An analysis of the location of the properties in the database for 2021 shows that the highest proportion of office property can be found in the Northern Harbour region (50% of all listings), followed by the Central region (at 31 %) — which is very similar to our 2020 database. With regard to retail properties, both these regions remain the dominant regions in proportion of listings, with slightly more such properties listed within the Central region. The Grand Harbour region represents a slightly greater proportion of office space than the South, however, the South region offers a substantially greater proportion of retail listings.

Turning to rental rates for retail property, average asking rates in the North Harbour and South regions saw substantial growth, (+58% and +17%, respectively) while average rates in the Grand Harbour region declined by 4%. Gozo and the North West region have been excluded from this analysis due to an insufficient sample size.