A brief overview of Malta’s post-Pandemic real estate market trends across three main property types, taken from The Construction Industry and Property Market Report 2022, researched by KPMG for the Malta Developers Association, with the support of the Property Malta Foundation.

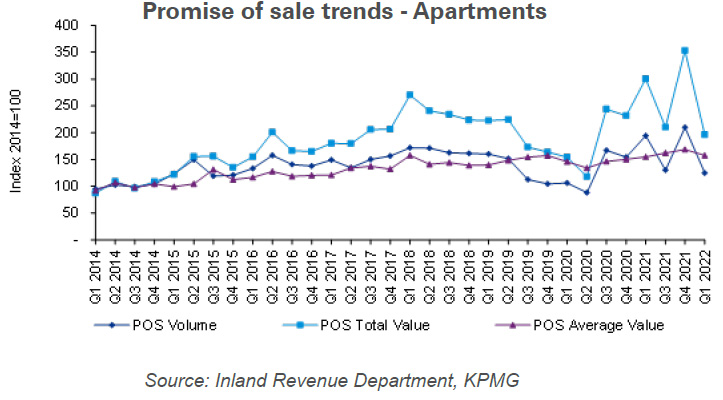

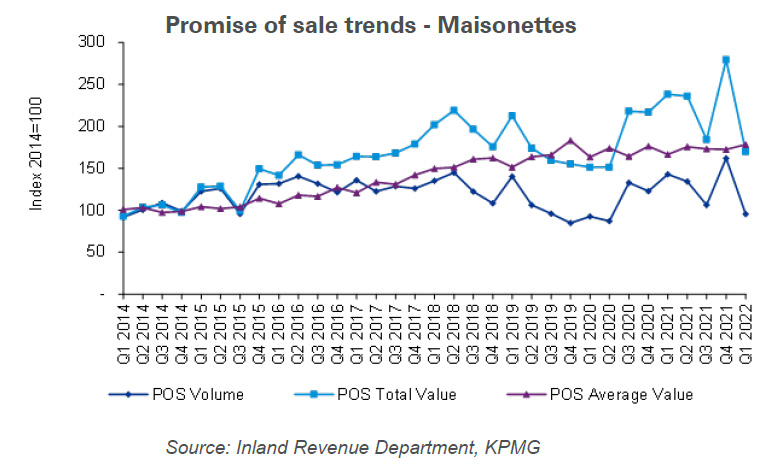

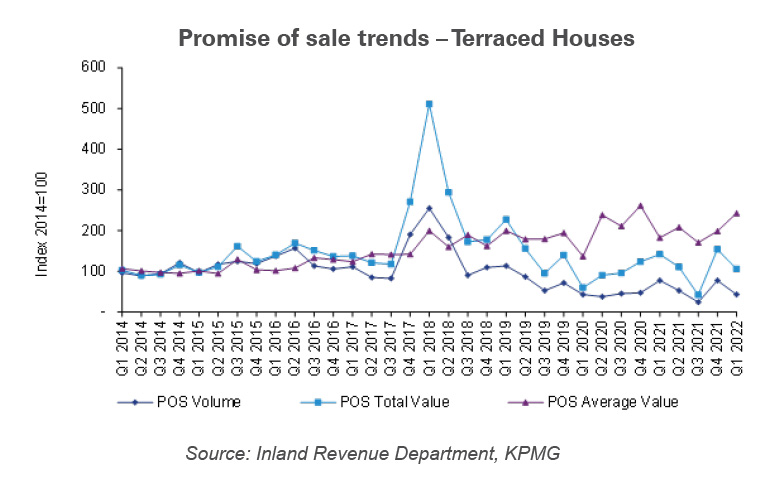

Data made available from the Commissioner for Inland Revenue gives further insight into property price levels, as well as sales volume. The following analysis considers the quarterly trends in Promise of Sale (POS) volume, and pricing for apartments, maisonettes, and terraced houses.

Comparing 2021 against 2020, one finds an increase of 40% in the quarterly average volume of apartment POSs, and an increase of 10% in the average contract value (up from €219,295 to €241,825). This growth lies in contrast with changes observed between 2019 and 2020 where POS volumes and contract values declined most likely due to the outbreak of the pandemic.

Comparing 2020 against 2021, one finds a 25% rise in the quarterly average volume of maisonette POSs, and no significant change in the average contract value (up from €235,784 to €239,404). Similar to apartments, the growth in POS volumes is substantially larger this year than in 2020, however, growth in average prices, has remained stable at 2% in both years.

When comparing 2020 against 2021, one finds an increase of 34% in the quarterly average volume of terraced house POSs, and a decline of 10% in the average contract value (down from €458,639 to €411,575). The spike in total value seen in Q1 2018 is attributable to an unusually high volume of sales during the period, including a number of properties of relatively high value.

Overall, this data suggests that sales of terraced houses are increasing while values have declined. This contrasts with the previous year when the opposite was observed, which gives rise to the possibility that this year’s findings may be partly attributed to a correction in the market. That said, the long-term trend that has been observed over the years for terraced houses is one which pushes average prices upwards, and POS volumes steadily downwards.

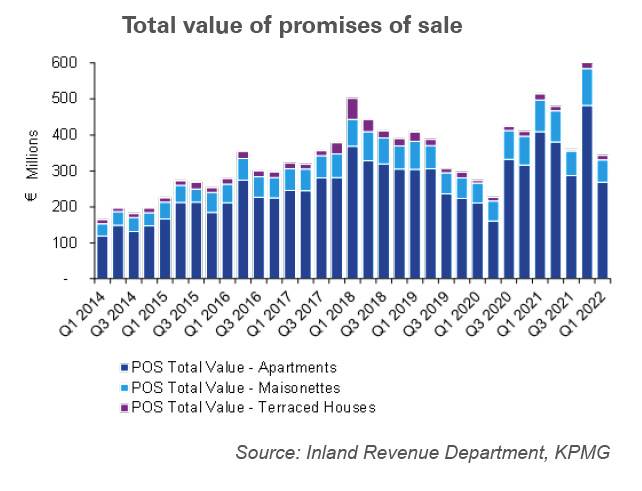

The total value of POS agreements for apartments, maisonettes and terraced houses increased consistently between 2014 and 2021, increased by 165% from a total value of €739 million in 2014 to €1.9 billion in 2021. Total sales value increased substantially over 2020 as well, with the former year seeing €1.3 billion in sales. Q4 2021 has been the strongest period since 2014, with a recorded €600 million worth of sales across these three property types. This may be attributed to the fact that many in the market sought to finalise promise of sales agreements by the year’s end to benefit from attractive government property schemes that were set to expire.

With regard to the proportion of sales value coming from each property type there has been little change over the period. Maisonettes consistently account for approximately 20% of total sales value. Apartments have seen their share of total value increase from just above 70% to just under 80%, while the proportion of sales value comprised of terraced houses has declined from around 7% to around 3%.